Compare credit cards

Search and compare credit cards to find the one that suits you

We work with leading credit card providers, including:

We're a credit broker, not a lender†

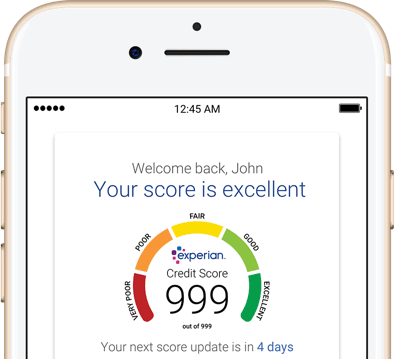

Take the guesswork out of applying for credit. Compare credit cards with Experian and you’ll see your eligibility rating next to each result. This gives you an idea of your chances of approval for cards before you apply.

What is your eligibility rating?

Your eligibility rating is how likely you are to be approved for a specific credit deal. We work it out by matching your credit information and details you supply against lenders’ criteria.

About your credit score

Your score won’t be affected. Checking your eligibility is a ‘soft’ credit search. This means it is not flagged as application for credit and won’t impact your credit score.

How accurate is it?

Your eligibility rating shows your chance of approval, it is an estimate and relies on you inputting your details correctly.

Comparing credit cards with us is completely free. It can save you time and effort, and will help you find a deal that fits. What’s more, it won’t affect your credit score. Not sure about what card you want? No problem – keep reading to learn more about the different types.

What kind of credit cards are available?

0% purchase

Pay no interest on new purchases for anything between a few months to a couple of years, but watch out for the higher interest rate after the 0% interest expires.

Balance transfer

Avoid interest on your existing card debts for a few months or years, but you usually need to pay a small transfer fee.

Balance transfer & purchase

Avoid interest on both new purchases and your existing card debts. But be aware of transfer fees and higher rates after the 0% interest deal ends.

Cashback & reward

Earn rewards and cashback as you spend with your card. Just remember to bear in mind these cards often have high interest rates, so it’s important to make sure the benefits outweigh the costs.

Improve credit

These cards can be a way to improve or build up your credit rating. Usually with higher interest rates, but lower limits to help you stay in control.